OnPath Credit Union

Here We Grow!

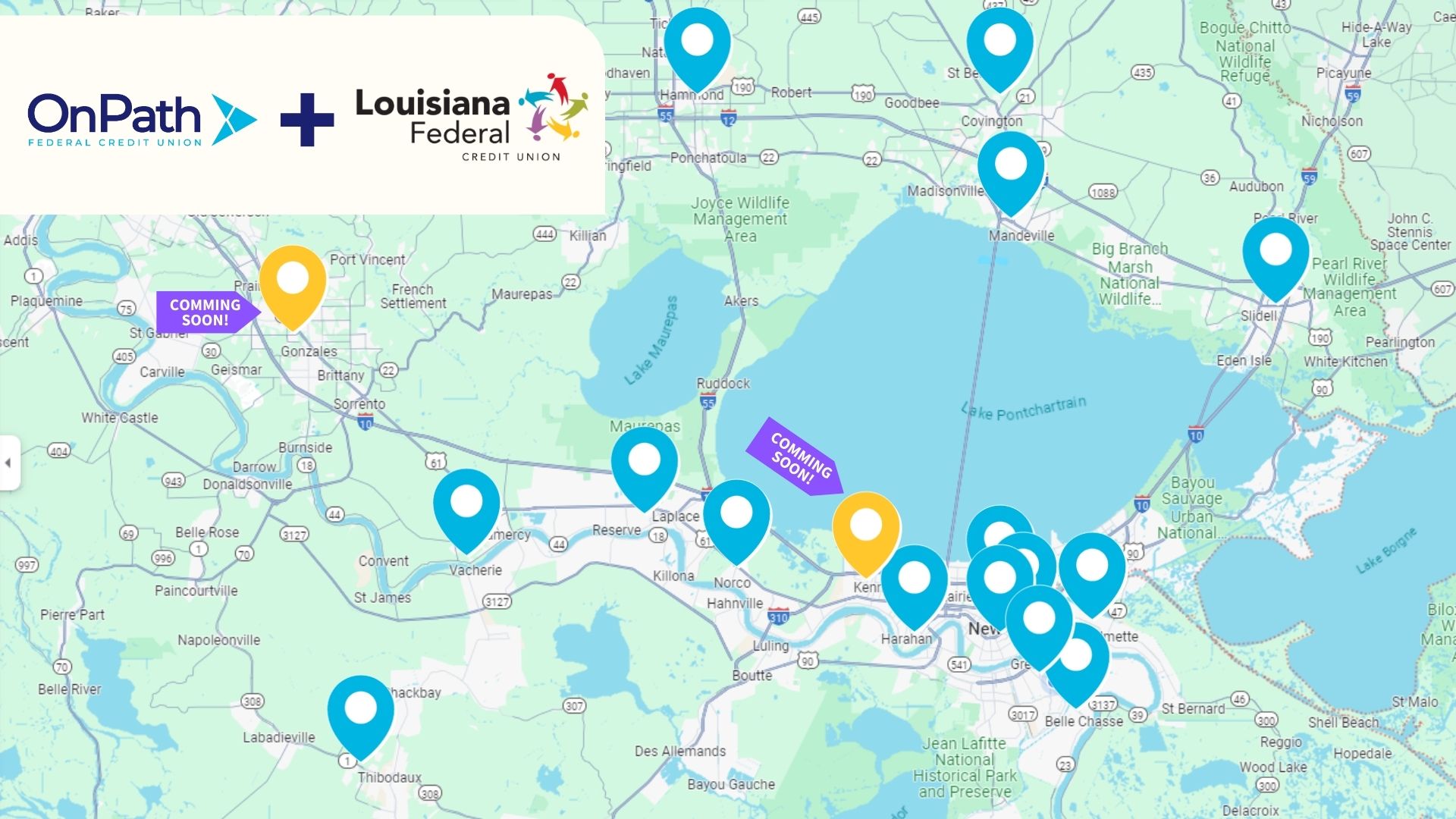

OnPath FCU and Louisiana Federal Credit Union come together for better banking!

TOGETHER FOR BETTER.

On May 29, 2024, members of Louisiana Federal Credit Union voted in favor of merging with OnPath Federal Credit Union. This exciting partnership brings together two strong and healthy organizations to benefit all our members and communities. We're thrilled to join forces and become "better together."

By joining forces, we can offer you:

- 15 branches and an expanded ATM/ITM network, putting us closer to where you live and work.

- 270 staff members to give you the help you need, when you need it.

- Stronger community presence and support.

- Continued investment in digital technologies.

- More products and services to meet your needs.

Questions? See here for Answers

OnPath branches are not available to Louisiana FCU members immediately. As the merger progresses, we will announce when these locations become available for members.

Yes. Both credit unions are committed to providing high levels of service for members, and this continues to be a focus for the combined credit union.

The strategic merger between OnPath and Louisiana Federal Credit Union provides the opportunity to achieve more positive member impact and value such as:

- More Member Access

With our expanded branch footprint, members will have more locations to conduct business with us, resulting in greater member impact. Beyond that, through this successful partnership, our field of membership has expanded, and we will be able to serve even more people and communities throughout Louisiana. - Products/Services

This merger will enable us to offer an even more robust product and service line, reduce costs, and return more value to members through enhanced products, services, and community involvement.

- More responsive to evolving financial needs:

In a highly competitive financial services industry, combining our strengths allows us to continue to enhance our product, service, and digital banking offerings. - Enhanced electronic banking products:

This partnership allows us to constantly assess and improve our technology solutions and make sure we’re providing “the best” digital banking solutions we can for members now and into the future. - More branch locations:

Together, we now have 14 branches to serve our members, and we will continue to explore opportunities for further expansion.

- Same knowledgeable, friendly employees:

The same friendly staff at our branches will continue to be available to serve our members.

- More Member Access

Currently, there are no plans to close any branches. In fact, this merger provides the opportunity to expand our branch locations and enhance our digital member experience.

Louisiana FCU was originally established on March 15, 1935, as the Norco Refinery Employees Federal Credit Union. Operations began on site at the Shell Oil Refinery. In 1963, the CU built its first stand-alone facility located in Norco. During the late 1980s, the CU expanded its field of membership to include small companies in the River Region and Tangipahoa Parish. As a result, the CU changed its name to Louisiana Federal Credit Union to better reflect its changing membership. A second branch was opened in LaPlace in 1992 with its third following in Hammond three years later.

In 2004, River Parishes Federal Credit Union merged into Louisiana FCU which resulted in a fourth branch located in Reserve. This branch closed in 2006. In 2006, the CU opened a student branch inside of East St John High School. The branch ceased operations in 2012 after the school suffered catastrophic damage from Hurricane Isaac. In 2008, the CU established a full-service branch in Gramercy of the St James Parish market. In 2012, preparations began to relocate the original Norco branch to a more suitable location in the heritage market. In 2014, the CU relocated the Norco branch to Airline Hwy. Four years later, the CU merged with $10MM Shell Geismar Federal Credit Union and expanded its service area to Ascension Parish. The CU merged with $9MM Loup Employees CU of Convent, La in 2020.

Our choice was grounded in shared values and visions. Both credit unions share a dedication to members, employees, and the community, and share a common vision for the future of the combined credit union.

OnPath rose from the docks of Avondale Shipyards Inc., as ASI Federal Credit Union in 1961. From 1961 to 2019 ASI grew to extend its membership to almost 64,000 members and has expanded across Southeast Louisiana and beyond. In 2019, ASI (Avondale Shipyard, Inc) Federal Credit Union, re-designed its brand and changed its name to OnPath Federal Credit Union. Using the feedback of members and the community in general, the new brand design was created to include a new name that captured the past and represented a vision for the future.

OnPath is committed to living the credit union philosophy of "people helping people." Their mission is to be financial advocates for our members and the communities they serve.

Jared Freeman, the current CEO of OnPath Credit Union, is the CEO of the new, merged organization. Rhonda Hotard, the current President/CEO of Louisiana FCU, has become the President of the merged credit union.

Current OnPath FCU members will see very few changes during the transition period, in fact, it will continue to be business as usual. Any changes will continue to be communicated to members as we work towards full integration of our systems and processes.

Absolutely. The boards of both credit unions have unanimously approved the merger and are excited about the growth and benefits this merger brings to our members, employees, and the wider community.

No employees will lose their jobs due to the merger. Both credit unions value the importance of our dedicated staff for a successful integration. We anticipate that growth will bring about expanded opportunities for professional development and advancement within our team. The member-facing staff in each location will remain in those locations unless they decide to explore a new opportunity.

The rates on fixed-rate loans and certificates will remain the same until the end of their existing terms. As always, market conditions may influence adjustments to other products in the future.

The combined credit union will eventually operate under the name OnPath Credit Union. New branding will reflect the strengths and heritage of both credit unions, honoring our shared history while looking forward to our joint future.

Yes. Rest assured that your savings with the combined credit union continue to be federally insured by the National Credit Union Share Insurance Fund (NCUSIF). Information regarding NCUA insurance, and a calculator to help determine your coverage, is available at www.mycreditunion.gov/estimator.