Protect your savings beyond limits.

What is access share insurance?

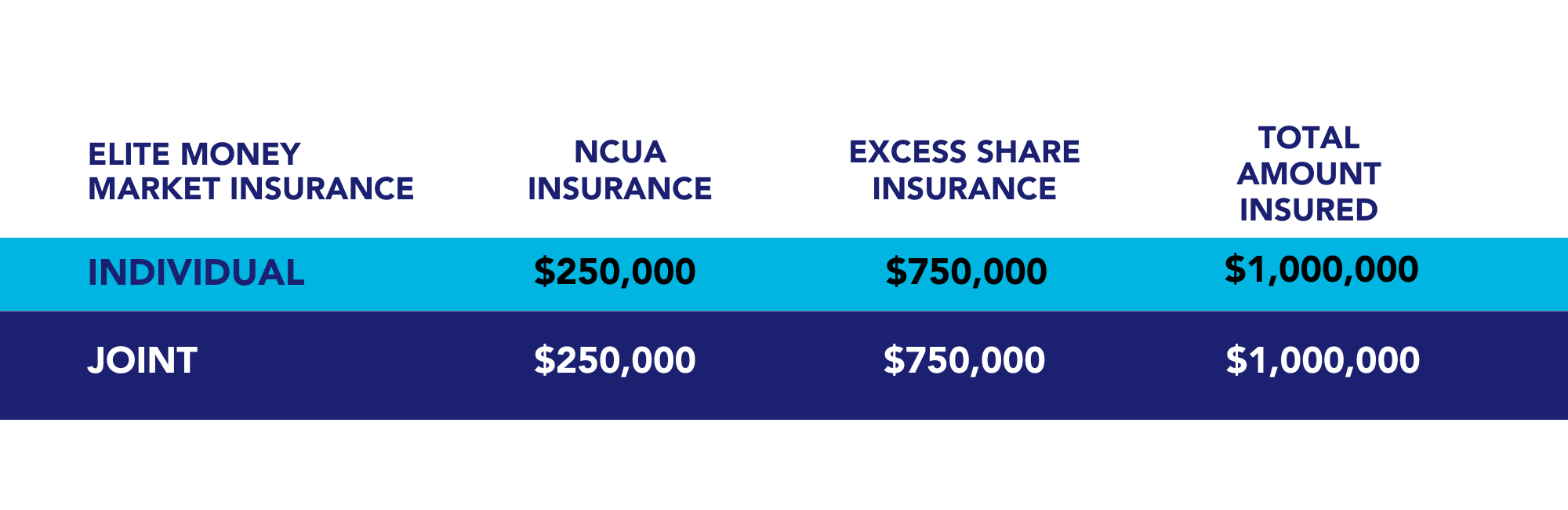

Life can be unpredictable, but your savings shouldn’t be. That's why our Elite Money Market Account* comes with Excess Share Insurance (ESI), giving you up to $750,000 of extra deposit protection on top of the $250,000 already covered by the NCUA. That’s a total of $1,000,000 in insured savings — so you can rest easy, knowing your money is safe.

Keeping your saving on the right path.

Our Elite Money Market Account is designed to help you save smarter, combining better returns, top-notch security, and easy access to your money. You’ll enjoy higher interest rates that grow your savings faster, plus the peace of mind that comes with up to $1,000,000 in total insured deposits. And when you need to access your funds, you can do so confidently, knowing your money is safe and working hard for you every step of the way.

Coverage Per Member with Excess Share Insurance

Both ESI and NCUA offer coverage payable only upon failure and liquidation of the credit union. We're here to help secure your savings!

ESI's Policy

To qualify for excess coverage, Louisiana Federal Credit Union and OnPath Credit Union must meet ESI’s strict underwriting standards. Members do not receive individual policies, and there is no additional cost to you for this protection. Louisiana Federal Credit Union or ESI may modify or discontinue this coverage, but if any changes occur, you will be notified in writing.

Disclosures

*APY = Annual Percentage Yield. The 5.00% APY on an Elite Money Market Savings Account applies only to new money with balances of $25,000 or more. Dividends are paid monthly. Rates may change without prior notice, and other terms and conditions may apply. Deposits are federally insured by the NCUA. Additional insurance coverage up to $750,000 is available for qualifying accounts through OnPath FCU's private insurance via Excess Share Insurance Corporation. For more information, visit BeOnPath.org or Louisianafcu.org.